Wages calculator wa

You can choose an alternate State Tax Calculator below. 2022 Minimum Wage Calculator.

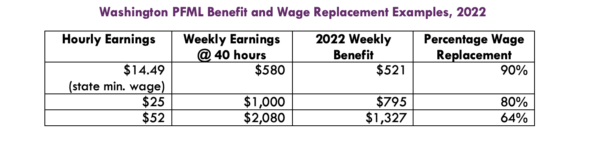

Estimate Your Paid Leave Payments Washington State S Paid Family And Medical Leave

Just enter the wages tax withholdings and other information required.

. For 2022 the wage base is 62500. Try a Free Demo. Ad Takes 2-5 minutes.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Wages calculator wa Jumat 02 September 2022 Edit. Washington is one of several states without a personal income tax but that doesnt mean that the Evergreen State is a tax haven.

This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family.

Washington Hourly Paycheck Calculator. Use ADPs Washington Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Estimate garnishment per pay period.

1 2022 the premium rate is 06 percent of each employees gross wages not including tips up to the 2022 Social Security cap 147000. Payroll tax is assessed on the wages paid by an employer in Western Australia. Compare options to stop garnishment as soon as possible.

Save Time Resources with ERIs Reliable Compensation Planning Tools. This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay rate. Washington Salary Paycheck Calculator.

Estimate your weekly pay. Calculate your Washington net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4. Washington State Unemployment Insurance varies each year.

Use this calculator to quickly estimate how much tax you will need to pay on your income. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Washington. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

This calculator can determine overtime wages as well as calculate the total. The Minnesota income tax calculator is designed to provide a. Ad Current Compensation Data for 9000 Positions 1000 Industries 8000 Locations.

Transportation Network Company TNC Driver Pay Calculator. Well do the math for youall you need to do is. You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in Washington.

This calculator is always up to date and conforms to official Australian Tax Office rates and. However federal income and FICA Federal Insurance Contribution Act taxes are unavoidable no matter where you work. How to calculate annual income.

For example if an employee earns 1500. Paid an hourly wage and I earn about the same amount of money every week Paid an hourly wage and the amount I earn changes a lot from week to week or. While taxpayers in Washington dodge income taxes they pay.

This calculator can assist you with estimating your payroll tax liability. Washington state does not impose a state income tax. All other pay frequency inputs are assumed to.

23 rows Living Wage Calculation for Washington. Of this employers with 50. Your liability depends on.

Rates also change on a yearly basis ranging from 03 to 60 in 2022. Let us know your questions.

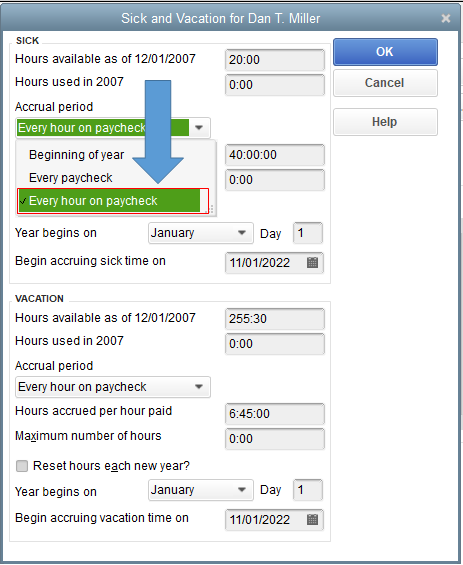

Solved How Do I Set Up Sick Leave Accurals For The New Wa State Sick Leave Law 1 Hour Earned For Every 40 Hours Worked

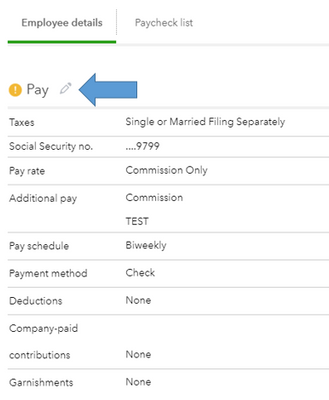

Tip Tax Calculator Primepay

Payroll Time Conversion Chart Payroll Calculator Decimal Time

Solved How Do I Set Up Sick Leave Accurals For The New Wa State Sick Leave Law 1 Hour Earned For Every 40 Hours Worked

Washington S Paid Family Medical Leave Program After Two Years Of Operation Economic Opportunity Institute Economic Opportunity Institute

Washington Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Wa Health Embarks On Massive Payroll System Overhaul Strategy Software Itnews

Solved How Do I Set Up Sick Leave Accurals For The New Wa State Sick Leave Law 1 Hour Earned For Every 40 Hours Worked

Pay Calculator

Motion Picture Projectionists

Calculator 2 Washingtonltctrust Org

Aus Processing State Payroll Taxes For Australia

2

Estimate Your Paid Leave Payments Washington State S Paid Family And Medical Leave

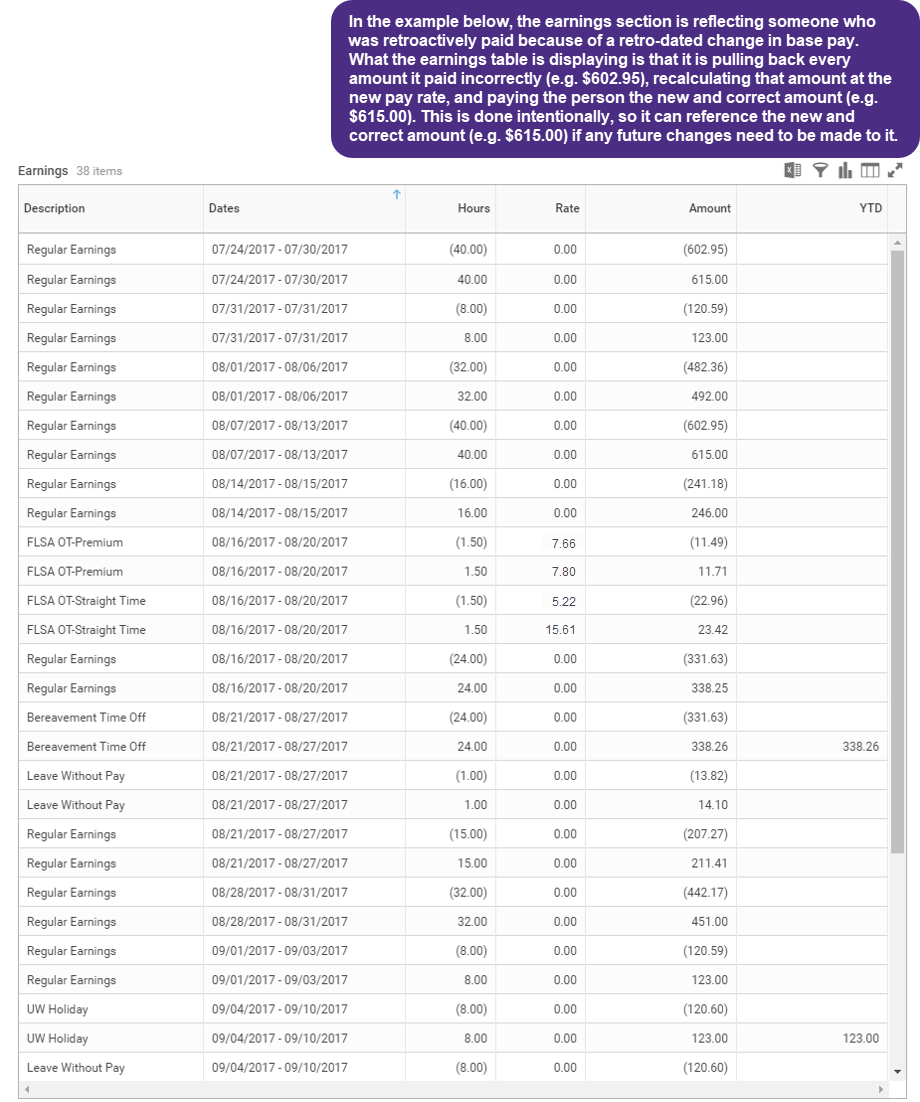

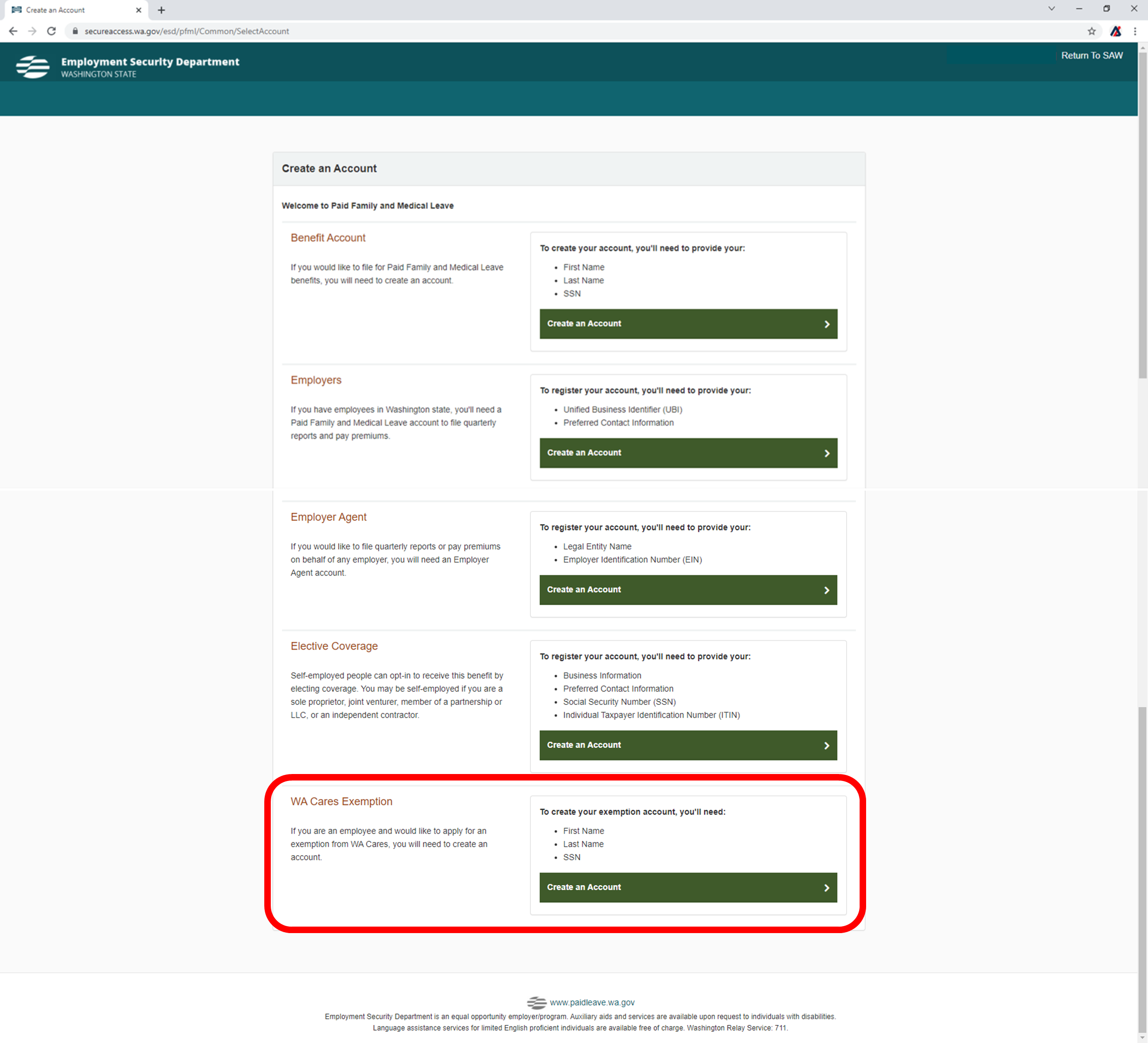

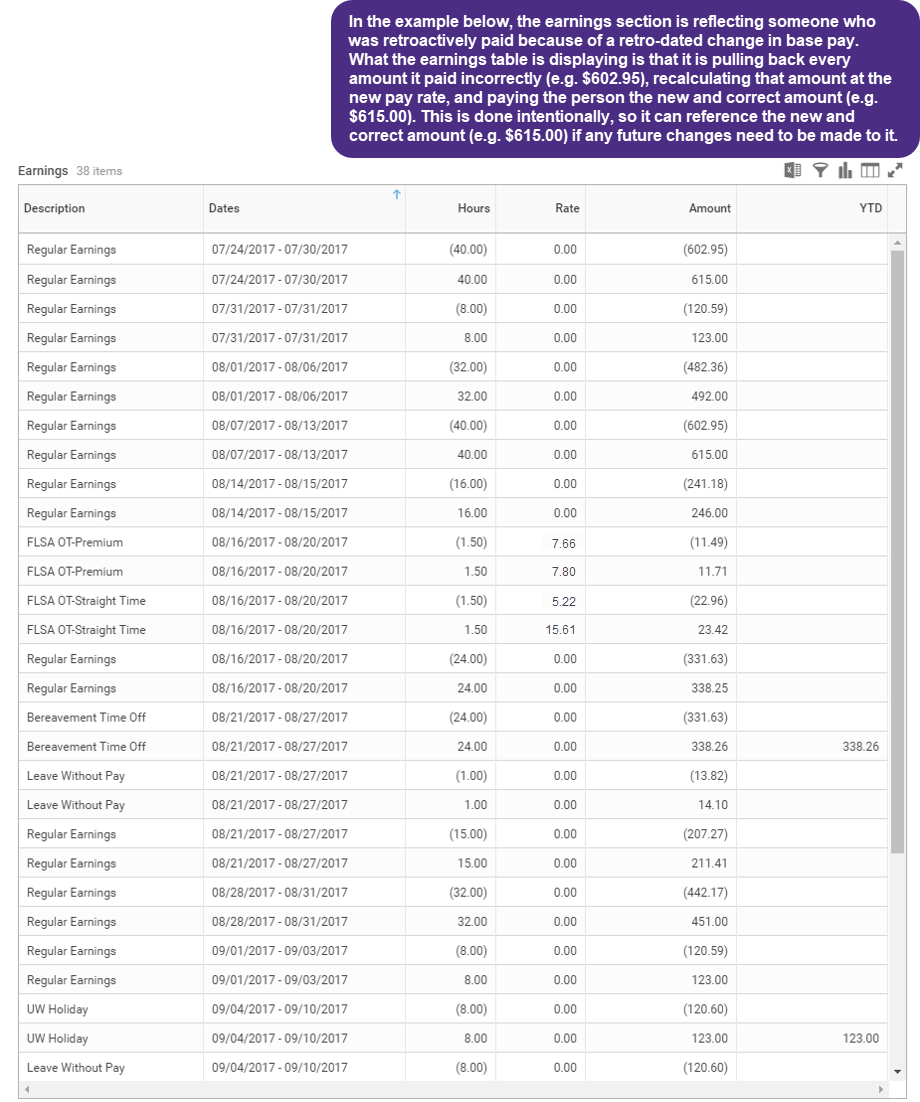

How To Read Your Payslip Integrated Service Center

Washington Paycheck Calculator Adp

Pers Plan 2 Department Of Retirement Systems