Sales profit percentage formula

Gross profit margin which is a percentage is calculated by dividing gross profit by revenue. The profit formula is stated as a percentage where all expenses are first subtracted from sales and the result is divided by sales.

Profit Margin Profit Cost Of Goods Sold Formula

Net ProfitPercentage 12000 60000 100.

. This gives you the gross profit percent which you can evaluate to determine profitability. Profit Percentage Margin Net Profit SP. This gives you the gross profit percent which you can evaluate to determine profitability.

Gross profit 1000000 51000 490000. Use the below-given data for the calculation. The information about gross profit.

Net income sales net profit margin. Net Profit Percentage 20. Finally convert your dollars into a percentage by multiplying the resulting number by 100 percent.

Each line item is linked to a percentage calculated. Therefore the profit earned in the deal is. For gross profit gross margin percentage and mark up percentage see the Margin Calculator.

First they prepare in-depth financial statements. To figure this out the team decides to use the percentage of sales method. To calculate the profit percentage you will need the below-mentioned formula.

The gross profit would. Old Number Current Year Sale. Using the example retail company apply the formula when the gross profit is.

Gross profit revenue 50000 100000 05. Profit 30 - 25 5. Operating Profit is calculated using.

Net Profit Margin Net Profit Revenue. Using the example retail company apply the formula when the gross profit is. Calculate the net sales of the company if sales returns are.

Where Net Profit Revenue -. Total sales COGS Gross profit. Net Profit Percentage Net Profit Total Sales 100.

Net Sales Formula Example 1. Profit Percentage 525 100 20. Sales - Expenses.

The gross profit percentage would be calculated as follows. Total sales cost of goods sold operating costs net profit. Profit Percentage Markup Net Profit SP.

Operating Margin Operating Profit Net Sales. First of all we will calculate the change in a sale by applying the formula. Gross Profit Percentage Gross Profit.

10000 7000 1000 2000. 2000 10000 02. Using the Profit Percentage Formula Profit Percentage ProfitCost Price 100.

02 100. Let us take the example of a company that sold 100000 units during the year each unit worth 5.

I Found This Formulae Very Helpful It Shoes Four Different Ways Of Calculating Degree Of Operating Leverage Also It Breaks Down Contribution Margin Sales Var

Margin Definition Gross Profit Margin Profit Margin Formula Operating Profit Margin Infograph Financial Literacy Lessons Economics Lessons Finance Education

How To Calculate Your Business S Break Even Point Video Included Marketing Budget Data Driven Marketing Contribution Margin

Excel Formula Get Profit Margin Percentage Excel Formula Excel Tutorials Start Up Business

Cost Of Goods Sold Formula Calculator Excel Template Cost Of Goods Sold Cost Of Goods Excel Templates

Retail Markup Calculator Markup Pricing Formula Excel Margin Formula

Gross Profit Percentage Meaning Example Advantages And More Accounting Education Economics Lessons Learn Accounting

Excel Formula To Calculate Percentage Of Grand Total Excel Formula Excel Excel Tutorials

Excel Formula To Add Percentage Markup Excel Formula Excel Microsoft Excel

Profit And Loss Important Formulas Profit And Loss Statement Aptitude Loss

Cape Ratio Accounting And Finance Accounting Principles Financial Management

Profit Or Loss Startup Business Plan Gross Margin Start Up Business

Gross Profit Vs Net Profit Definitions Formulas Examples Net Profit Accounting Training Profit

Inventory Costing Accounting Education Bookkeeping Business Inventory Accounting

Calculate Profit Margins Using Measures In Microsoft S Power Bi Power Dax Calculator

Calculating Profit Anchor Chart 4th Grade Math Financial Literacy Lessons Anchor Charts 4th Grade Math

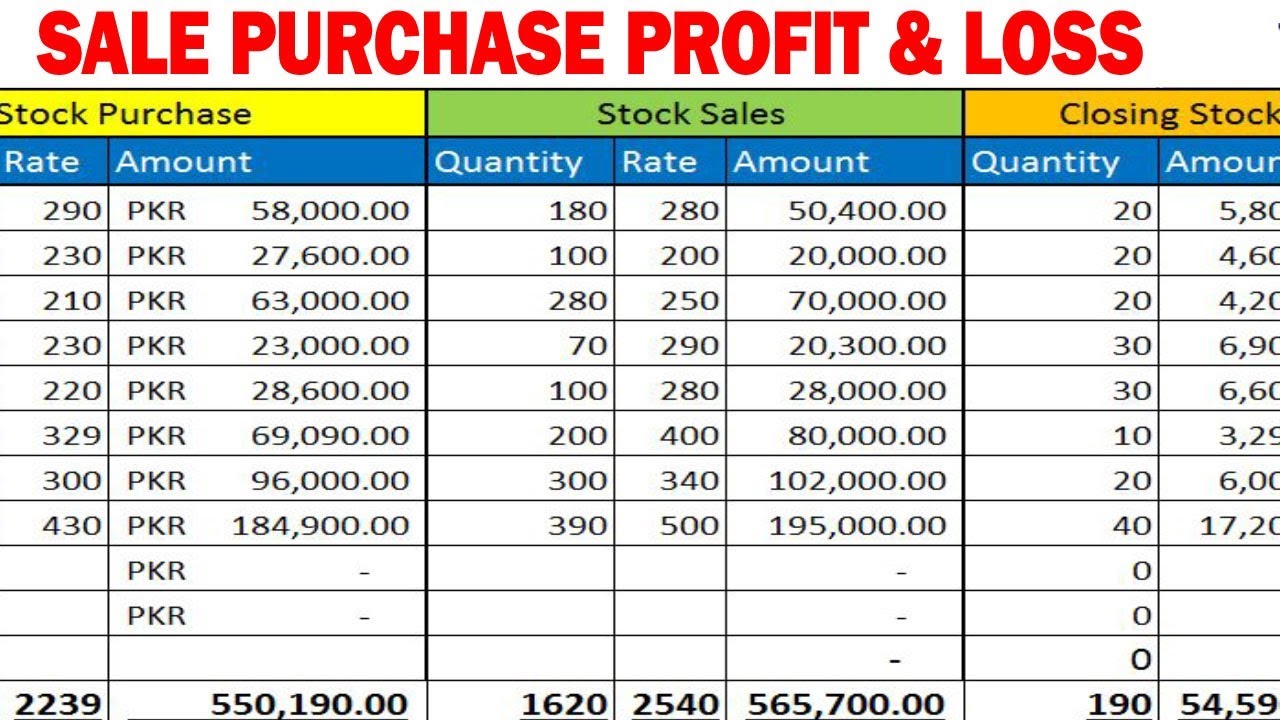

How To Make Stock Purchase Sales And Profit Loss Sheet In Excel By Lear How To Make Stock Learning Centers Excel Tutorials